Public and private investments in smart manufacturing and technology is driven by a $26 billion government investment. The $453 Billion Saudi Non-Oil GDP's Continued Expansion Provides Importers and Exporters with Massive Opportunities.

The number of industrial units in Saudi Arabia experienced a 10% surge in 2023, reaching a total of 11,549. A total of 1,379 new industrial licenses were issued. Food products, non-metallic mineral products, formed metal products, and rubber and plastic products units being the top four sectors. Suppliers of control and automation systems, robotics and other smart plant and machinery will see increases in their sales pipelines as the surge is set to continue in 2024 and beyond.

Alat’s strategic objectives include providing sustainable manufacturing solutions to assist its industrial partners in reducing emissions and transitioning to carbon-neutral production. Manufacturing automation, robotics and other smart manufacturing technology applications suppliers will see new opportunities opening up in 2024 to start the transformation process in the imports of heavy machinery and technologies to facilitate Alat’s vision.

Saudi Arabia is to allocate $40 billion to become the

largest global investor in the AI market, showcasing

the Kingdom’s global business ambitions as well

as advancing efforts to diversify its economy. The

manufacturing sector is already taking advantage of

new AI technologies and Future Factories Program

to increase the Kingdom’s manufacturing output,

international competitiveness and grow the non-oil

economy. Sales opportunities of smart technologies,

plant and machinery are expanding now.

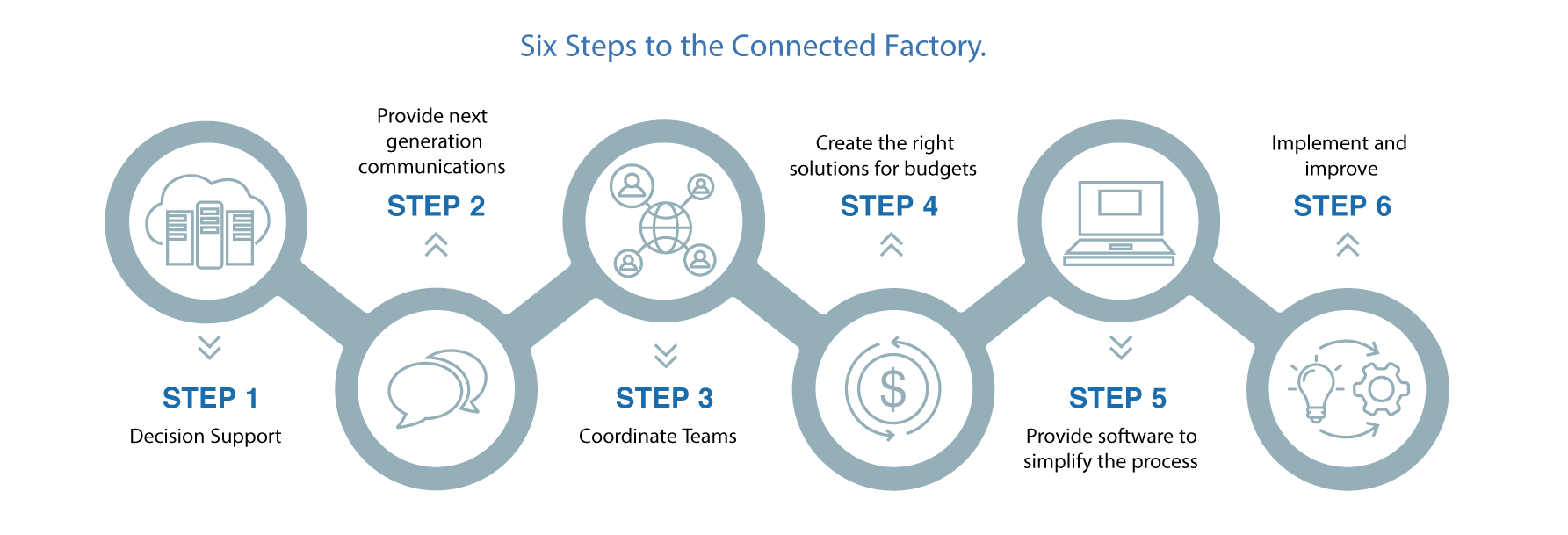

The digital infrastructure in Saudi Arabia has witnessed a remarkable development since the announcement of Vision 2030. Through the Industrial City Communication Infrastructure Initiative, optical fibres and wireless networks in industrial cities has facilitated the adoption of modern technologies such as 5G and IoT. This enables the digital transformation of the manufacturing base in Saudi Arabia to create connected factories. Opportunities for digital infrastructure and technology providers and manufacturers of smart machinery and connected factory equipment are seeing a huge uplift in their sales pipelines.

Notifications